ESG is an investment approach that explicitly incorporates the environmental, social, and governance factors in investment decisions, keeping an investment portfolio’s long-term return at the forefront. Environmental factors concern the natural world, including using and interacting with renewable and nonrenewable resources. Essential considerations include biodiversity, deforestation, water security, pollution, and climate change. Social factors include human capital management, local communities, Labor Standards, human rights, health and safety, and customer responsibility.

anniversary of the foundation of the United Nations, which came into existence

in 1945

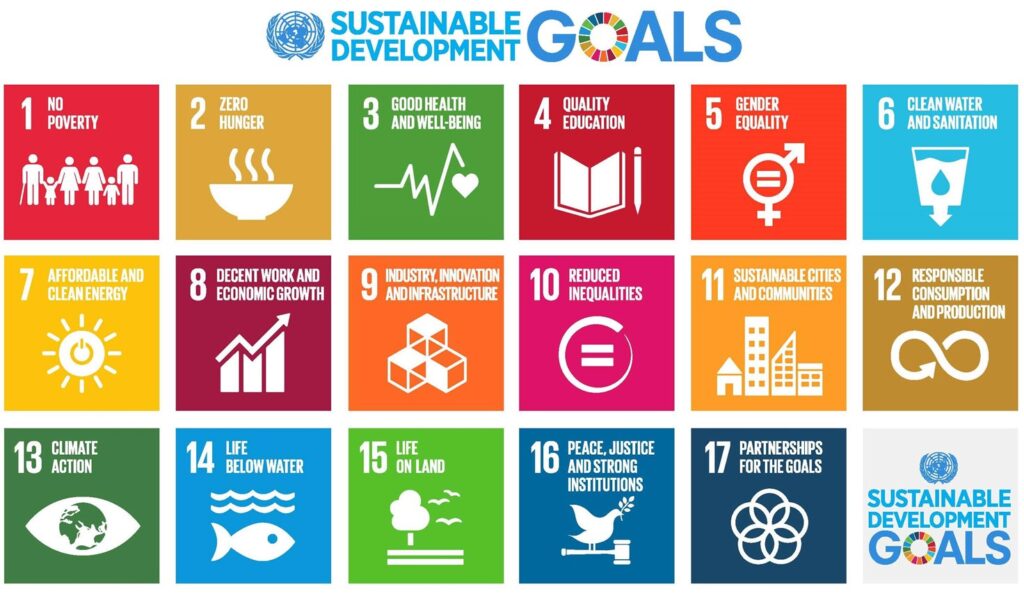

The governance factors involve issues tied to the interest of the broader stakeholder community, risk management, corporate governance, anti-corruption, and tax transparency. The ESG investment is a part of investing approaches collectively named responsible investment. To invest responsibly means to intend to impact the environment or society positively. Being socially responsible considers the issue of sustainability in the investment decision-making thinking about green investment, such as allocating capital to assets that mitigate climate change or biodiversity loss. Social investment intends to address social challenges faced by the bottom of the pyramid (BOP – refers to the poorest 2/3 of the economic human pyramid including more than four billion people leaving in poverty). The responsible investment framework is built around the U.N. Sustainable Development Goals (SDGs), shown in the Figure, addressing global challenges such as poverty, inequality, environmental issues, peace, and justice.